The critical mineral powering the energy revolution with unprecedented growth across multiple sectors

Market Size by 2030

Demand Growth by 2030

Li-ion Battery Market 2029

Supply Growth 2025

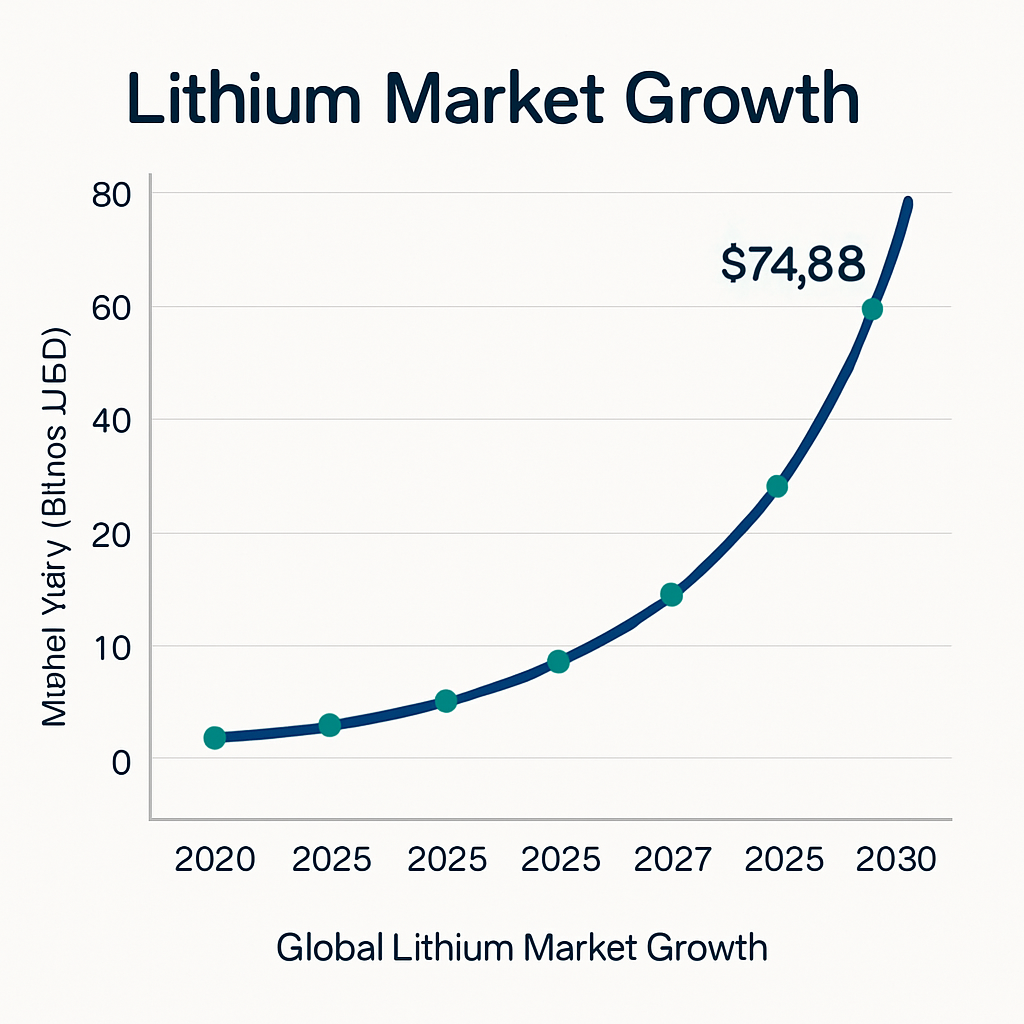

The lithium market represents one of the most compelling investment opportunities of the decade

CAGR 2025-2030

Market Size 2030

Growth by 2030

Growth by 2034

Strategic Lithium Holdings for the Energy Transition Era

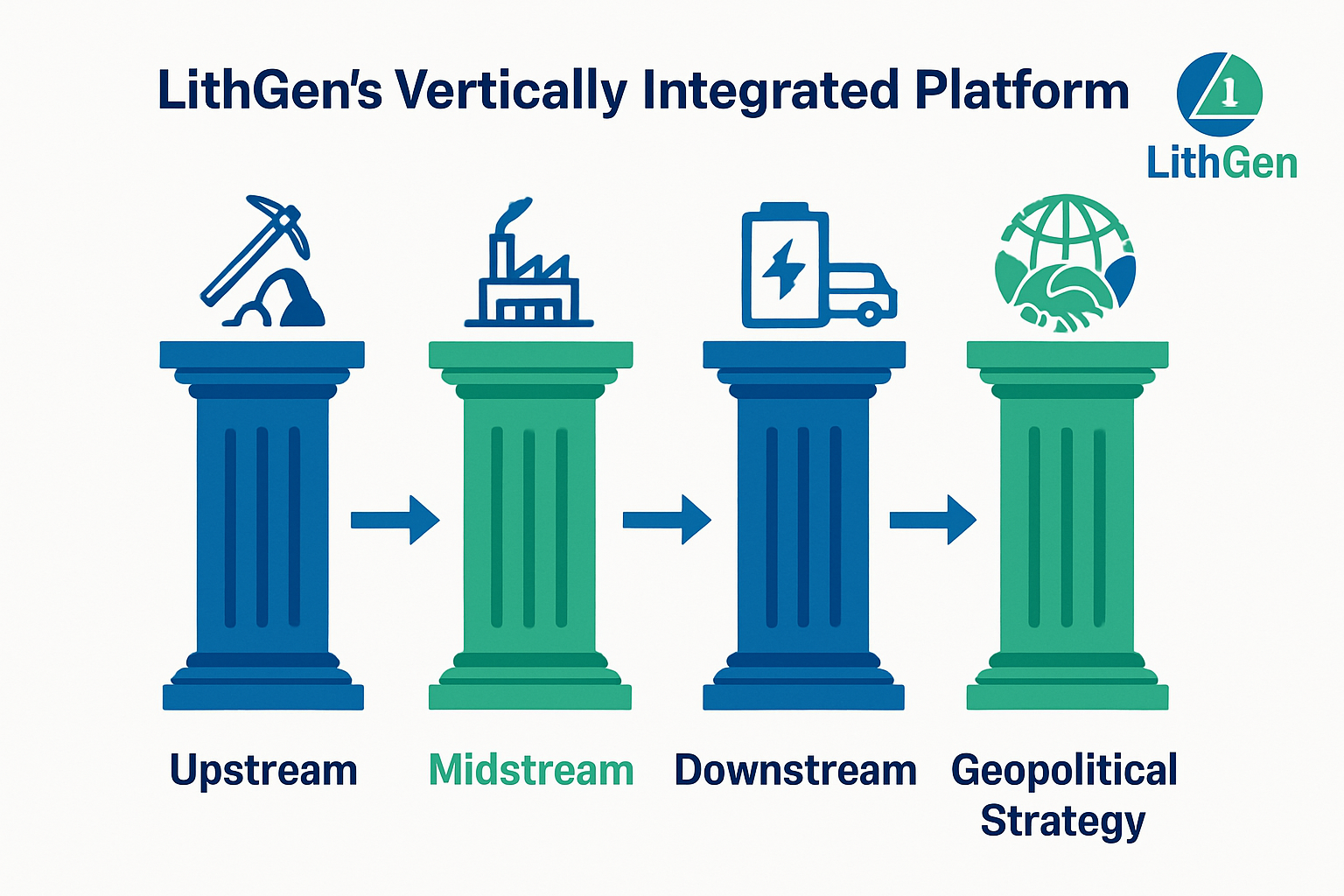

LithGen is a lithium-focused holding company at the forefront of energy security, geopolitical realignment, and industrial transformation. We operate at the nexus of critical minerals, sovereign capital, and clean technology to build a resilient lithium supply chain.

Supporting electric mobility, AI infrastructure, and national defense priorities across the U.S. and allied nations.

Strong geopolitical expertise in lithium-rich regions

Aligned with sovereign wealth fund priorities

Designed for long-term value compounding

Access to policymakers and regulators across the U.S., GCC, and LATAM, enabling strategic positioning in critical mineral supply chains.

Priority entry to Tier-1 mining projects and offtake agreements through established relationships and strategic partnerships.

Focused thesis on energy sovereignty, defense logistics, and industrial decarbonization aligned with global policy trends.

Four-Pillar Strategy spanning the entire value chain

Strategic Capital Deployment for Lithium Value Chain Integration

Positioned for lithium market recovery and long-term demand growth

Access to Tier-1 lithium deposits in stable jurisdictions

Reducing dependence on Chinese lithium processing

Clean energy, AI infrastructure, critical minerals focus

Tangible asset exposure tied to energy transition

Lithium as strategic material for national security

Ready to capitalize on the lithium revolution?

Contact us to discuss investment opportunities.

Cross-Border Expertise in Energy, Private Equity & Diplomacy

Co-Founder

Co-Founder

Co-Founder

With extensive experience in cross-border private equity, natural resource strategy, and energy diplomacy, our team leverages deep relationships with sovereign wealth funds, government ministries, and defense sector leaders. LithGen is uniquely positioned to catalyze a secure and future-proof lithium supply chain bridging Gulf and Western stakeholders.

To become the premier platform connecting secure lithium supply with growing global demand, bridging geopolitical divides through strategic energy partnerships.

Building a resilient lithium supply chain that supports the global energy transition while ensuring energy security for allied nations.